SPOTIFY DIRECT DEALS vs MAJOR LABEL ARTISTS

Research by Gillian Robins, Analysis/Writing by Jason Joven

Career options for music artists are now many…we’ll explore the major label and independent ones w/ Chartmetric data.

After Spotify’s April 2018 initial public offering (IPO), a lot of ink has been spilled on the Swedish music streaming giant’s theoretical “direct deal” licensing with independent artists. Here’s the initial June 6 2018 exclusive from Billboard, and their detailed follow-up already written on the phenomenon.

Long story short: Spotify has courted favor with the “Big Three” major labels (Universal Music Group, Sony Music Entertainment, Warner Music Group) for years to gain access to the biggest artists of the Western world and their recorded music repertoire, which typically are 100% copyright-owned by those labels. Permission was granted (and equity received), labels prospered in the digital music era, and Spotify grew.

After the IPO and the Big Three (and the independent digital rights-focused Merlin Network) made out with a nice liquidation, Spotify’s gloves came off, and allegedly began negotiating directly with independent artists and their managers. “Independent” in this case means completely do-it-yourself (DIY), as opposed to being signed to an independent label- which likely are hit worse due to their smaller market shares.

Essentially, Spotify and artists would cut out the “middleman”. The value for Spotify is that they could pay out less to the artist than their label, and the artist would receive a higher percentage than they would probably receive from their label anyway.

A valid argument for the major labels is “100% of nothing is still nothing.” Here’s what happens in the absence of a major label: no six-figure advances, no access to a decades-deep radio promotion network, no physical distribution infrastructure, no global marketing system in place. In other words, there’s no career bandwagon to jump on…just a long, long road to walk.

But for many freedom-oriented DIY artists, that’s exactly the road they want to take. Enabled by a laptop and WiFi, select artists have proven to be quite capable of connecting with their fans in effective and profitable ways. The digital aggregator, forged in the 1990s and itself coming in several flavors (non-selective like CDBaby, Tunecore, DistroKid; selective independents like Believe Digital, Fuga, INGrooves; or major-label-owned distributors such as The Orchard, WEA, or Caroline), became these artists’ gateway to Spotify, Apple Music, iTunes, Deezer and the dozens of digital streaming providers all over the world.

The Merlin Network provided independent digital rights muscle to the most successful of these artists, while newer players such as Willard Ahdritz’s label service AWAL (under the Kobalt Music Group umbrella) have come to provide scalable multi-functional services such as up-to-the-minute data analytics, streamlined royalty collection, playlist pitching, sync licensing, and marketing support.

So the question is: who’s winning? Traditional major label artists or wholly independent ones? What does “winning” even mean in this case?

While we at Chartmetric can’t answer definitively, we can try to provide some clear-eyed data into this discussion.

// Methodology: “Major” vs. “DIY” Teams

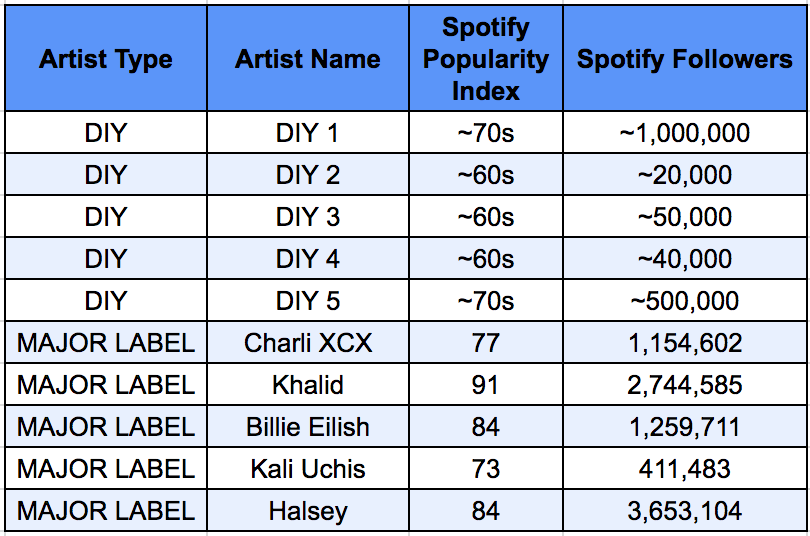

To explore, we’ve selected a handful of artists on each side of the equation: five “Major” artists and five “DIY” artists as samples. Of course, such a small number cannot be statistically significant, but the nature of a relatively new industry topic relegates our scope to a case study-level.

From there, we can analyze their aggregate “success” metrics such as Spotify Popularity Index, Facebook fans, YouTube views, TV/film syncs, Spotify playlist placement, etc.

One important thing to note is we will attempt to move past the “more is better” mentality. More than likely, we are expecting the Major team to outnumber the DIY on most metrics. As much as streaming and social media have theoretically leveled the playing field for artists of all legal statuses, the truth is that systematic industry practices (e.g., radio promotion) still heavily favor the Major team in sheer scale of exposure, which feeds upon itself and creates a significant disadvantage for the DIY team.

The DIY artists have been anonymized, as they were tipped to Chartmetric as having possible “direct” licensing deals with Spotify. Even if any alleged Spotify direct deal is no longer current or never even existed, the DIY artists’ legal and creative status is still worth measuring against major-label acts. It is with this disclaimer that we will proceed.

We identified a general “vibe” among the five DIY artists, which was very electronic-tinged with notes of indie pop, dance, and hip-hop. They are from different countries (three ex-US, two American) and all are primarily English-speaking in their content. We will refer to these artists as DIY 1, 2, 3, 4 and 5.

So in an attempt to control for other factors, we identified five major-label artists (subsequently referred to as “majors”) with similar genre aesthetics, also all English-speaking: Kali Uchis, Khalid, Charli XCX, Billie Eilish, and Halsey.

At first glance, we can see the majors already outdoing the DIYers in both Spotify’s Popularity Index (SPI) and Spotify Follower Count, which is expected.

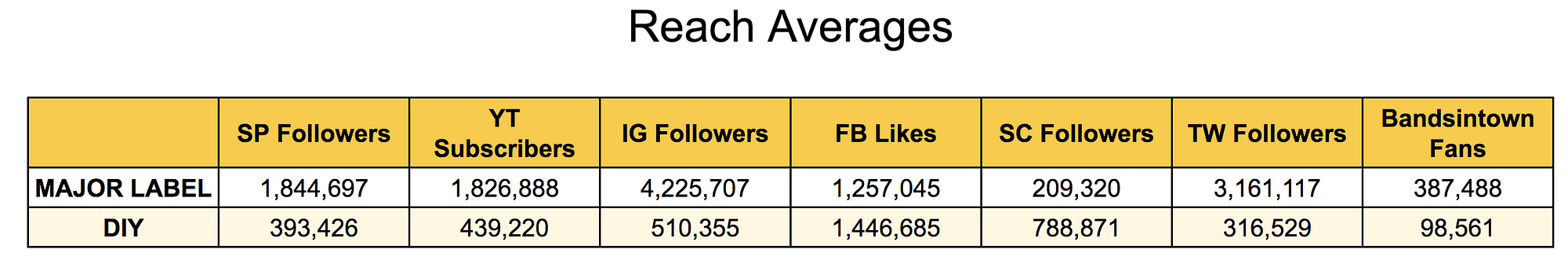

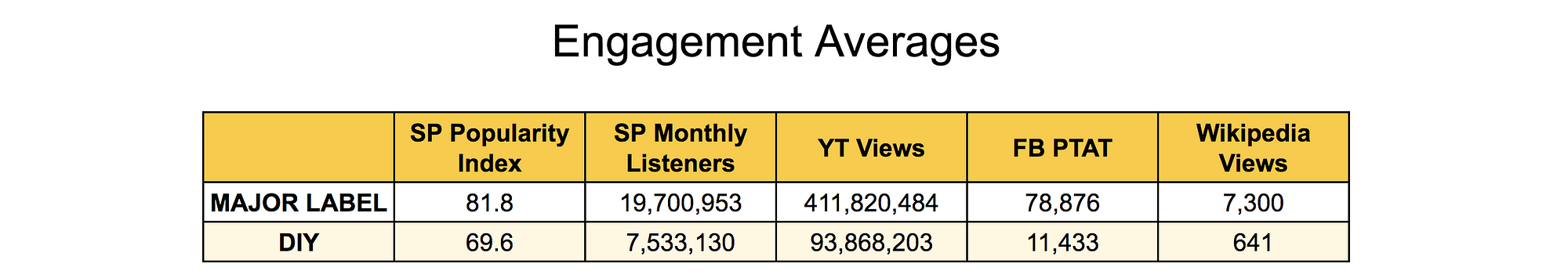

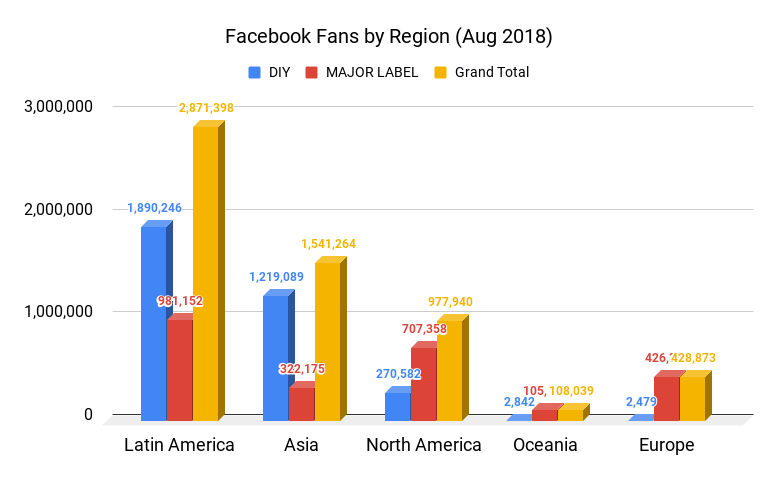

When aggregating the groups by average (instead of medians: we chose to include outliers to capture their achievements), the same expected story. Majors > DIYs, with the only aberrations being Facebook Likes and SoundCloud followers.

The Facebook data (note: this particular source is only current to Jan 31 2018) is worth mentioning, as it helps show where each group is coming from going into the April 2018 Spotify IPO.

Both Latin America and Asia as regions speak very loudly on the Facebook platform, with DIY artists winning big in Mexico (1M vs. 482K), India (578K vs. 113K), and Indonesia (381K vs. 0). Majors take the US (670K vs. 270K), Brazil (417K vs. 337K) and the Philippines (209K vs. 148K).

Looking at the same Facebook fans by region, it’s very noticeable that the DIY artists have a rare win by numbers in Latin America and Asia, while the majors dominate North America, Oceania and Europe. While this is certainly a reflection of Facebook’s own unique user base, it also helps give our subsequent Spotify geographical analysis a framework to work from.

The second DIY win here was for SoundCloud followers, and was likely due to DIY #1 being an electronic music artist and the Berlin-based platform having a deep, global reputation in the genre. As such, the median of the majors in this category is over 188K fans, well over the DIY median of 14K, so this is more of an outlier than a decisive victory for DIY artists.

In all practicality, we could call the “totals” war a sweep by the major artists. However, once we get underneath the “more is better” mentality, we can start to get more nuanced insights on these groups.

// DIYers for the Win: Global Streaming Audience

Geography provides us another lens for us to filter some of these totals through, and now we will focus on Spotify itself as a platform.

The DIY artists feature a much more cosmopolitan fanbase. In Spotify monthly listeners, streaming’s borderless nature seems to have truly come to life in these independent artists’ career paths.

The above charts shows a very distributed monthly listener geography for DIY artists, with Europe (34%) and Asia (31%) playing major roles in their Spotify fanbase in addition to North America (24%). The major-label artists are strongly entrenched in North America (64%) with only Europe (25%) being the only other region of importance. To the last point, a better way to summarize the major label artists’ Spotify monthly listener distribution is English-speaking territories, as their only European city in this case is London, while the DIY artists also feature Oslo, Paris, and Stockholm.

It’s interesting to note that Latin America unexpectedly plays a small role in both groups, possibly as a language barrier rather than this type of electronic-pop music (Spotify’s Vibras playlist is very much in this sound’s vein, with 634K follows), just as well excluding Oceania (despite being primarily English-speaking in Australia/New Zealand). However, we’re only limited to ten artists in all of Spotify’s ecosystem, so we will abstain of sweeping generalities for such small margins.

In the Spotify monthly listener distribution chart by city above, the green-highlighted boxes show which group of artists have a higher percentage of their own fans in that city. Keeping with the regional analysis, four of the five US cities (except for San Francisco) are taken by the majors in addition to London and São Paulo. DIY artists take over from Quezon City (14%) in the Philippines to Mexico City (7%) to Paris (5%). It’s important to remember that the DIY artists’ global spread is that much more notable considering that Spotify is not always the dominant streaming platform with Apple Music in the global mix, along with others such as in France where Paris-based Deezer continues to be a major music player.

Though DIY global spread may seem like such a brave new world, it also is a natural feature when considering the instantly available nature of digital music. More than likely, this reflects the lack of incentives for major labels to advocate outside of their home markets. The territory-centric corporate structure of the major labels encourages local executives and staff to focus on domestic repertoire.

While revenue may indeed flow from a foreign affiliate to their American headquarters, that same foreign affiliate will make more money per artist on their own primary (and local) artists. Thus, affiliate labels focus on their own culture, language and promotional networks, and even if one of their artists (American ones included), have a passion for their fans halfway around the world…the label might not be structurally motivated to dedicate resources to it, when one follows the money.

DIY artists, while in command of significantly less resources, are free of these organizational constraints.

We believe, even in this small sample of ten artists, that we begin to see hints of this dynamic play out across Spotify as a major difference in how major-label and DIY artists operate.

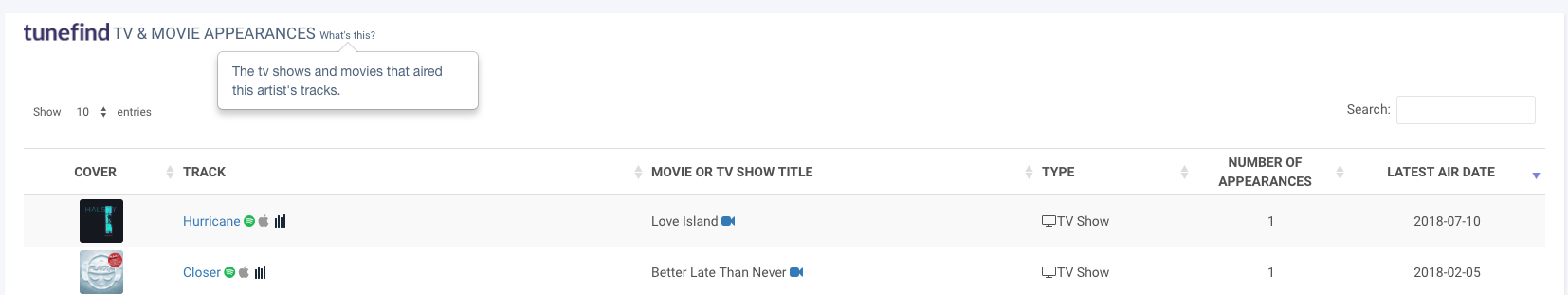

// Majors for the Win: TV/Film Sync Licensing

One advantage that major labels bring to their roster is access to huge, traditional media attention. Besides radio promotion, physical distribution and mainstream advertising (Times Square billboards are not cheap), another way this happens is via TV and film sync licenses.

Basically, this is when an artist gets one of their tracks to play over credits or in-scene background music. Video games and commercials are also other pieces of this sectors that the IFPI estimates at 9.6% annual revenue growth globally in 2017.

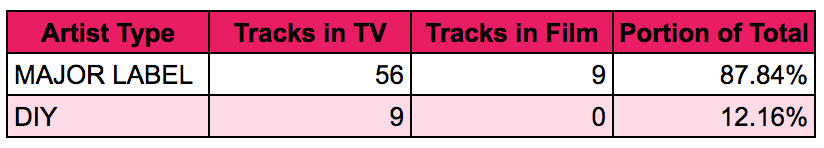

Out of the ten artists, there were 65 tracks total from our Tunefind dataset, with over 87% of the tracks were from the major artists.

WMG’s Charli XCX (15), UMG’s Billie Eilish (14) and Halsey (12), and SME’s Khalid (8) took the top TV sync spots within this sample, while the DIY group’s best performer (DIY #4) in this sense only had four TV placements.

From the network perspective, MTV appears to be both major-label and DIY-friendly, as two of their shows (Siesta Key and Scream: The TV Series) licensed from both groups, and had the most syncs from the DIY set (including reality dating show “Are You the One?” and “Undressed”).

The majors also swept all six appearances for any late-night talk show, with all five appearing at least once and SME’s Khalid making a second appearance along with label-mate Normani (of Fifth Harmony) in April 2018.

Halsey’s work apparently makes for great sync material, as she also has the most film placements (3), including 2017’s Fifty Shades Darker and Power Rangers.

UMG artist Halsey backing 2017’s Power Rangers film by Lionsgate with “I Walk the Line”

Though it only amounts to 2% of 2017’s global recorded music revenue ($.3B USD), sync licensing still represents a community of gate-keepers in the form of well-networked music supervisors, producers and showrunners. Chartmetric’s data, even in this small sample size, is so lop-sided that we believe this is a major-label advantage artists should be aware of.

// Spotify Playlisting: It’s a Toss-Up

The most obvious advantage a streaming platform can offer an independent artist is inherent promotional power. No need to “know the DJ” to get into the proverbial club, when you’re dealing directly with the club owner.

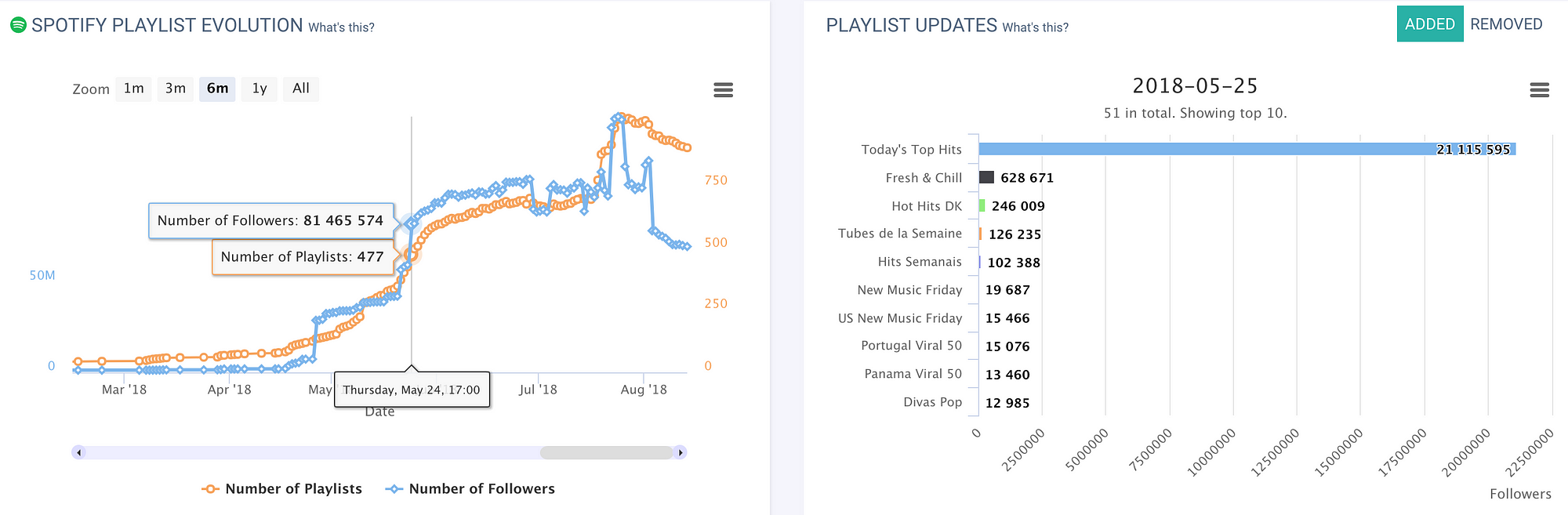

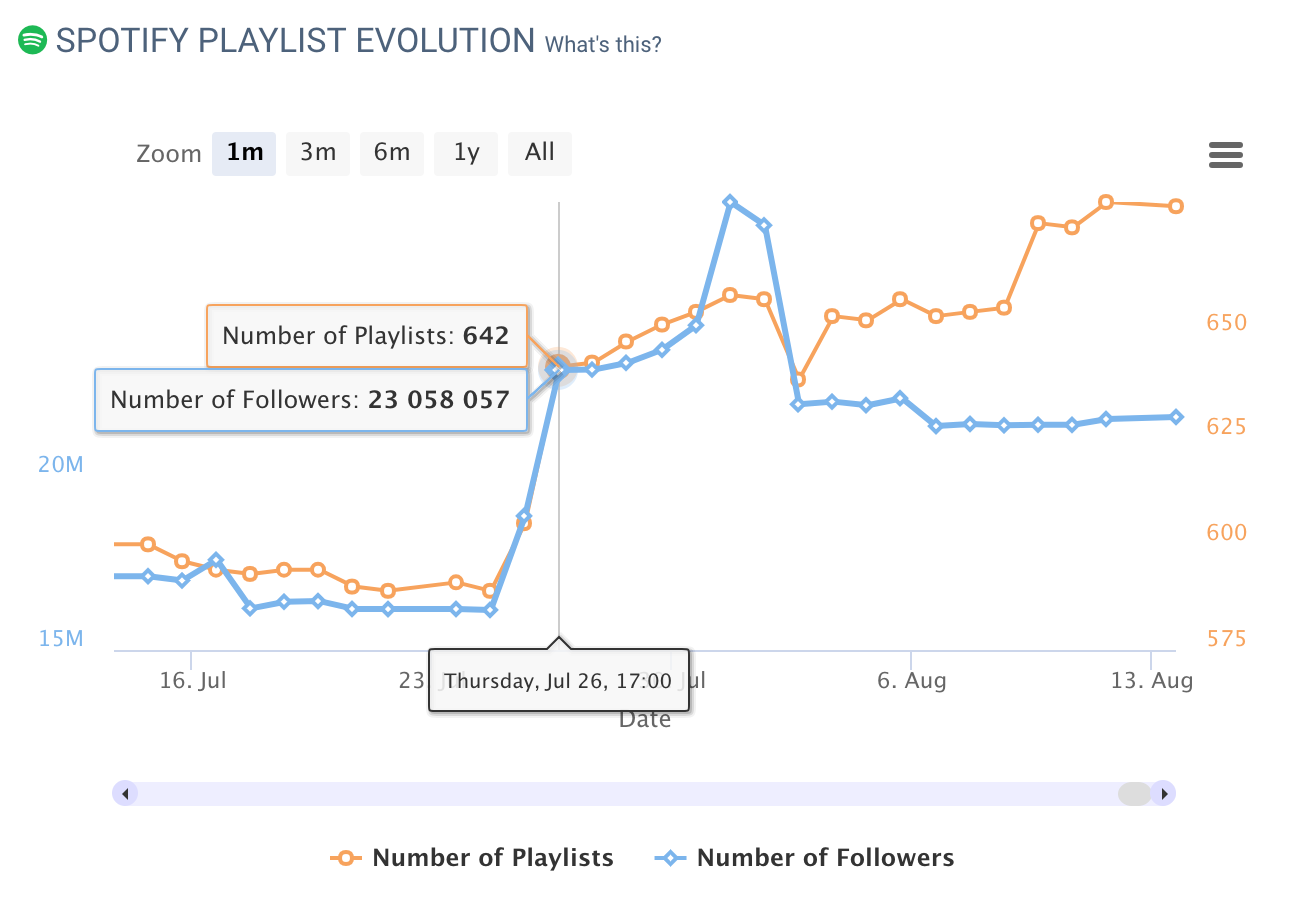

In the Chartmetric artist profiles, under the Playlists section, you’ll see “Spotify Playlist Evolution”, which tracks the number of Spotify playlists and the total number of followers from them all across time.

In examining all ten artists in the past six months…there actually is no apparent pattern. (Sorry, folks.) Though it would be neat to see some kind of magic bump in additional playlists for the DIY artists after the April 2018 IPO, any artist’s playlist evolution is still tied to how prolific they are for that time period.

However, the biggest jumps in followers (seen in the above left graph as the white-dotted blue line) tended to correlate with a Today’s Top Hits (the #1 most followed playlist), a Global Top 50 (#2 most followed) or a New Music Friday (can be territory-specific) placement.

The only real pattern observable is that the majors skewed towards Today’s Top Hits and Global Top 50 spots, as a highly-prized and likely very political playground for the Big Three labels, while New Music Friday playlists seem to be much more open to the DIY artists.

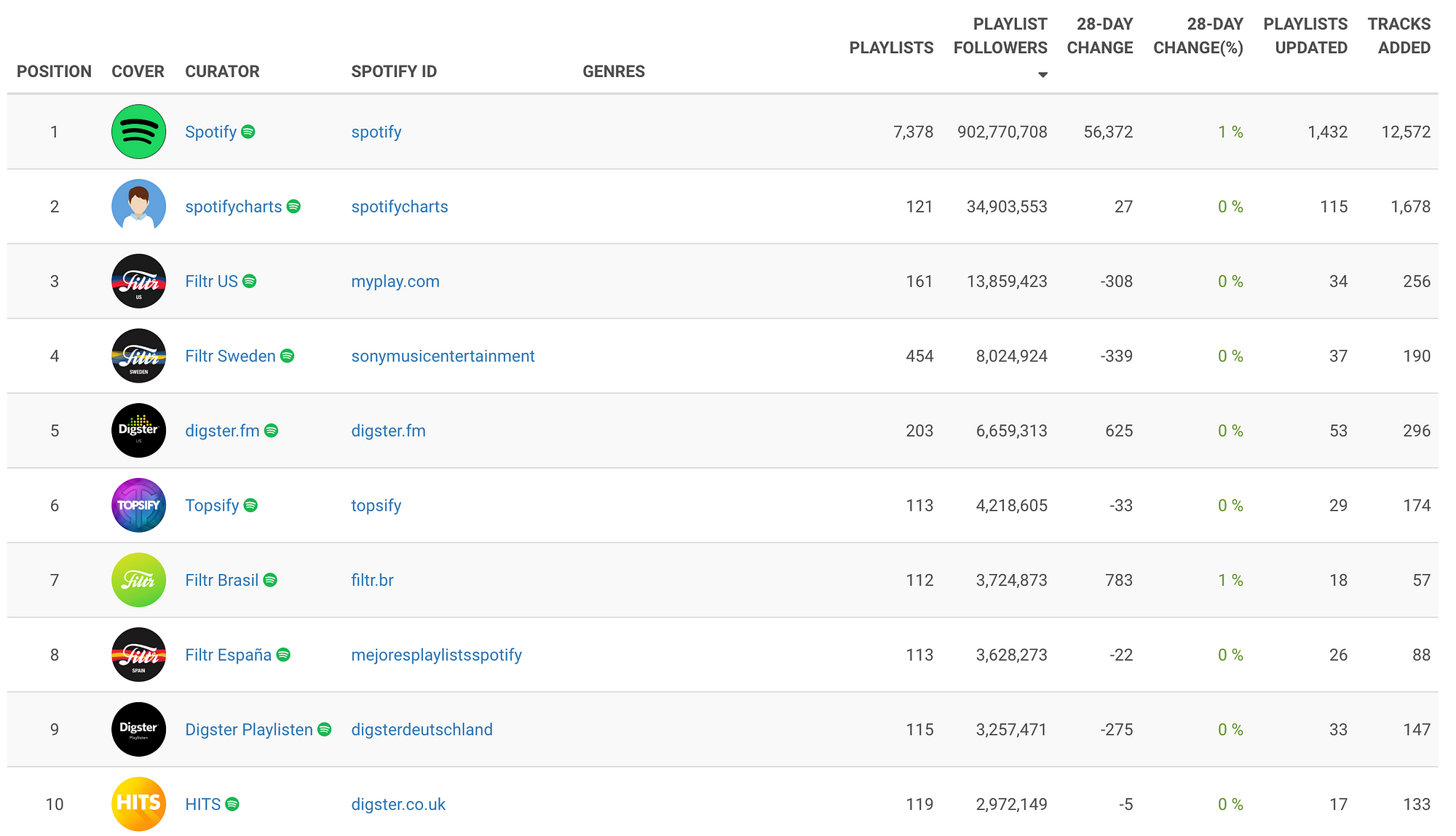

One more advantage the majors have in the playlist realm is their ownership of Filtr (SME), Digster (UMG) and Topsify (WMG)- Spotify’s biggest playlist curators outside of their own editorial staff. Running over 1.3K Spotify playlists with an aggregate non-unique followership of 45M+ (and this is only for the curators in the Spotify Top 10), if their artists for whatever reason fall out of favor of Spotify’s curators, the majors have the capability to automatically boost their artists’ stream counts by placing them in their influential playlists.

The only non-major curator to place in the Top 20 (that isn’t a major K-pop band or entertainment company like Billboard or Walt Disney) is Trap Nation at #19 with 11 playlists with an aggregate followership of 2M+. While if you’re a trap artist, this could be just the right 2M Spotify listeners you want to target…chances are DIY artists are significantly hampered in getting wide reach into the Spotify ecosystem, compared to the major labels’ collective curator market share. We look forward to collecting more data in this particular arena.

// To Be Continued…

Recently brought to industry attention by Apple Music and Tidal exclusives from huge artists like Drake and Frank Ocean in 2016, the DIY dynamic continues today with Spotify’s evolving growth as a publicly traded company.

October 2017 saw Spotify unveil its RISE marketing program with Kim Petras, Lauv, Russell Dickerson and Trippie Redd, and has recently updated with a second wave of artists in LANCO, Jorja Smith, Karol G and Rex Orange County. Their profiles feature exclusive video content and the artists have done Spotify-branded live events under the RISE banner. From a user-experience perspective, they feel much like how Spotify has treated its RapCaviar, Viva Latino and Hot Country sub-brands.

Most interestingly, Spotify has been happy to feature both DIY and major label artists through the RISE program, and then-Global Head of Creator Services Troy Carter was very clear in declaring they were not becoming a label.

With such a small, exploratory sample set, this is only Chartmetric’s first preliminary look into what is likely going to be a debate for years to come. We look forward to offering more data-driven insights to augment the public conversation, and hopefully inform the new choices now facing emerging artists in their careers.

Featured imabe by Mike Wilson on Unsplash